Cash Flow:

“Cash is King”. Cash flow is the lifeblood of all businesses. To survive in business, you need to have not only sales but also cash in bank. It is essential to identify potential shortfalls in cash balances in advance so that you can take necessary steps to avoid cash flow problems. Managing your cash flows will ensure that you will pay your vendor and employees on time.

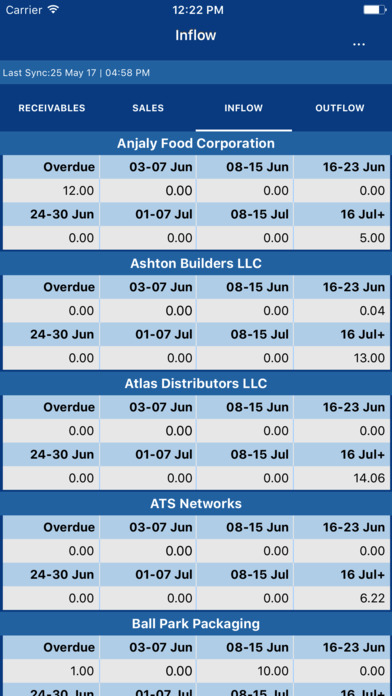

Receivables:

Accounts Receivable is sort of like cash inflow “in waiting.” If your customers are not paying timely, or not paying at all, your business will soon be without the cash flow it needs to pay your vendors and employees. Slow paying customers create significant cash flow problems as well as costing the company time and money to make the collection and possible interest expense on borrowed working capital.

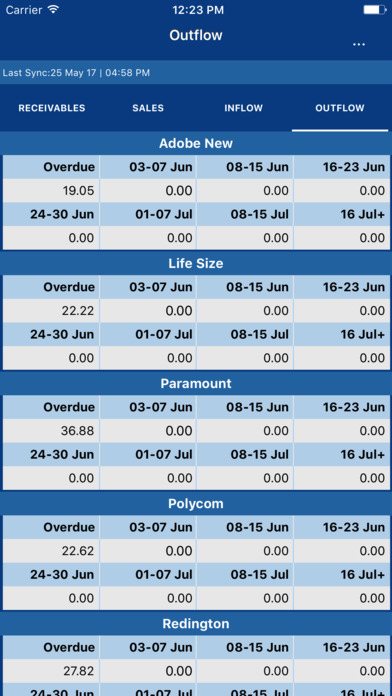

Payables:

Accounts Payable Management is a key indicator of overall operational effectiveness. How a company manages its accounts payable affects two important business matters: cash flow and vendor relationships. Good vendor relationships provide best trade credit terms and will maximize the company’s profitability. Delinquency can have an effect on your company’s credit rating, which can result in your company being charged higher interest rates on future loans.

PDC Management:

It is a practice in some parts of the world to offer credit to customers against receipt of Post Dated Cheques. The companies receiving PDCs need to ensure that they deposit the cheques on due dates and issuing PDCs need to ensure that they have enough balance in the bank to honor the cheques. Managing PDCs is very crucial for both customers and vendors.